What You Need to Know About Cargo Insurance

Cargo Insurance is a must-have when transporting goods. The insurance protects not only your goods but also your relationship with your shipping company and with your clients. Insurance for transporting freight over the road differs from insurance for transporting by cargo ship (based on ancient maritime law). Still, the question remains: are you adequately covered for a potential loss? Here are some fundamentals to consider.

Who: Clarify in terms of sale which party is responsible for ensuring. Usually, the party responsible for delivering the freight is responsible, whether they are the buyer or the seller. In many cases, goods will be insured when delivered by truck, but only at a marginal per pound rate. It may be a good idea to purchase additional coverage.

What: It’s essential to document each shipment’s value carefully. Remember that if you declare a "value" on a bill of lading, the carrier will have no choice but to upgrade its standard policy to insure the freight for the total value. This upgrade will be reflected on your freight bill. If you carry your own business insurance and it is sufficient to cover your goods, you may want to avoid declaring a value on the bill of lading.

Where and when: While some policies cover all transit modes, some only cover ocean vessels or exclude warehouse storage. If you doubt your own policy, most transportation companies will offer the option to cover your shipment.

Coverage: Anything can happen in transit: natural disasters, theft, damage, fire, collision, and more. Some policies exclude unusual risks such as war and piracy, so read carefully to know what’s covered, or take out an “all-risk” policy for peace of mind.

Cost: Cargo insurance is lightly regulated, so prices vary. Shop around to get the best deal. If what you’re shipping is unusual or complex, consider using a specialized cargo-insurance firm or per-shipment insurance from your LTL freight company.

Regarding cargo insurance, you may be able to use a preexisting business policy if it has coverage for goods in transit. Your trucking company will often have high-value rates negotiated if you wish to upgrade. Many companies do this as the insurance cost is listed on the specific freight bill. This makes it easy to associate with a particular shipment and simple to account for.

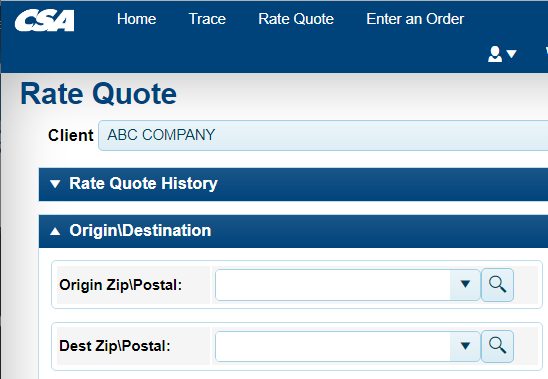

To learn about CSA’s cargo insurance coverage, check our insurance page, or contact us if you have specific questions about your shipment.