Top Training Grants for Businesses in Canada

A recent survey of 803 managers across the country shows that one of the biggest current challenges facing Canadian businesses is the acquisition and retention of skilled workers. As a small or midsize business, setting up and maintaining a formal skills and new hire training program may not be an easy option. But did you know there are a number of training grants available from both federal and provincial governments that can help ease the burden; some of which will subsidize your costs up to 66%!

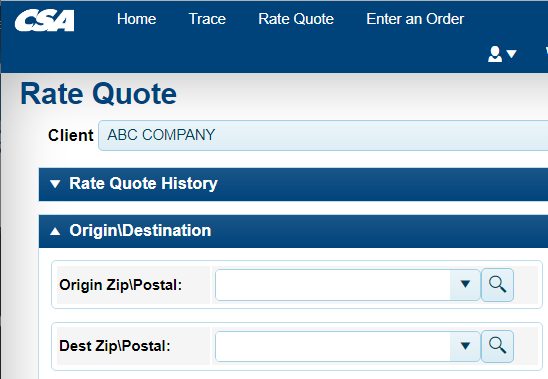

CSA has you covered with LTL freight expertise so why not start that training initiative for customer service that you've been putting off, or a shop floor safety program with help from some of these available grants?

Here's a list of the most popular training incentives currently available to Canadian businesses:

All Canada: Canada Job Grant (CJG)

This six year training grant is available across Canada (with provincial variants ie. Canada-Ontario Job Grant [excluding Quebec]) from 2014-2020 and covers up to 66% of third-party training costs. The maximum allotted per trainee is $10,000, but there is no maximum number of trainees that can receive CJG grants.

This program is open to incorporated Canadian businesses of all sizes and is intended for both existing and newly hired employees. As part of this program existing employees will need to receive a wage increase, a new job title, and avoidance of job loss.

A listing of province specific grants is available.

All Canada: Apprenticeship Job Creation Tax Credit

Specific to Red Seal Trades this non-refundable tax credit (up to 10 per cent of the eligible wages to a max of $2,000 per year) is available for apprentices for the first two years of their apprenticeship. Any unused credit can be claimed by businesses across Canada back three years and forward 20 years.

Ontario: Apprenticeship Training Tax Credit

Ontario businesses are eligible for this tax credit, which covers up to 25% of allowable expenses (30% for small businesses) to a max of $5,000 per year for each apprenticeship. Since not all trades qualify for this tax credit, it is recommended to consult with the government of Ontario’s complete list of eligible skilled trades before applying.

Ontario: Achieving Innovation and Manufacturing Excellence Global Initiative (AIME)

Established Ontario manufacturers are eligible for funding through the Yves Landry Foundation for training projects that improve productivity and export sales performance. Up to $50,000 is available. More grants available to Ontario businesses can be found on the Federal Economic Development for Southern Ontario (FedDev) website.

Quebec: Workplace Apprenticeship Program

The Workplace Apprenticeship Program is an on-the-job training program available for individuals 16 years of age or older employed in Quebec for voluntary-qualification trades - those not subject to government regulation. Though not a directly funded program, there is significant potential for tax credits as well as eligibility for the Apprenticeship Incentive Grant and Apprenticeship Completion Grant through the federal government.

The length of the program varies based on the chosen trade, the apprentice's pace of learning, and the apprentice's experience level in their designated trade. At the end of the training the apprentice receives a Certificate of Vocational Qualification or an attestation of competency.

Alberta: Canada-Alberta Job Grant

Alberta employers seeking third party training programs for their employees, either onsite, online, or in a classroom setting, are eligible for the Canada-Alberta Job Grant. The program involves three steps: application, reimbursement, completion. Government contributions will reimburse up to two thirds of direct training costs (to a maximum of $10,000), with a minimum of one third covered by the employer.

The purpose of the grant is to ensure employees are being trained in high-demand areas and is a joint effort between the Government of Canada and the Government of Alberta.

Other similar province specific grants are available, see Canada Job Grant.

British Columbia: British Columbia Training Tax Credit

Qualified apprenticeship programs through the Industry Training Authority (ITA) can be subsidized thanks to the BC provincial government’s Training Tax Credit. Having launched on January 1, 2007 and running through December 31, 2017, this credit is applicable for non Red Seal training programs and offers enhanced credits for First Nations individuals and persons with disabilities. Credits vary depending on the apprenticeship.

Manufacturing Government Grant:

All Canada:

The Industrial Research Assistance Program (IRAP) offers several Research & Development grant programs: Youth Employment Program (YEP) and the IRAP Accelerated Review Process (ARP) are two examples.

ARP is available to Canadian businesses that have been incorporated for at least 2 years for internal R&D projects. The program supports 80% of direct labour costs and 50% of subcontractor fees (to a maximum of $50,000).

Recommended uses for the grant are Business Process Mapping (BPM), Lean Manufacturing Initiatives, and projects geared at resolving technical challenges.

IRAP ARP grants release funding in April.