Largest & Busiest Sea Ports in the USA & Canada

North American Ports Hit Record Volumes Amid Infrastructure Boom

The North American port industry achieved unprecedented growth in 2024, with major container ports handling record TEU volumes while advancing billions of dollars in infrastructure investments. Despite significant labor disruptions, the five major ports examined demonstrate remarkable resilience and expansion capabilities that position them for continued dominance in global maritime trade.

Major Port Performance Surges Across the Continent

Port of Los Angeles - Western Hemisphere Leadership

The Port of Los Angeles maintained its Western Hemisphere leadership with a record-breaking 10.3 million TEUs in 2024, representing a nearly 20% increase from 2023 and marking the second-best year in the port's 117-year history. The port has held the #1 position in North America for 25 consecutive years and ranks 18th globally. Early 2025 performance continues this momentum with 924,245 TEUs handled in January alone—the busiest January in port history.

Port of Vancouver - Historic Milestones

The Port of Vancouver achieved historic milestones with 158 million metric tonnes of total cargo in 2024, including 3.47 million TEUs (11% increase). This performance solidifies Vancouver's position as the 4th largest container port in North America and Canada's largest port by total tonnage, handling nearly as much cargo as Canada's next five largest ports combined. The port serves 170 trading economies and facilitates 52% of Canada's offshore container trade.

Port of New York and New Jersey - East Coast Excellence

The Port of New York and New Jersey delivered exceptional East Coast leadership with 8.7 million TEUs in 2024, an 11.4% increase marking the third-busiest year on record. The port maintained its #1 East Coast ranking and achieved a remarkable milestone in March 2025, surpassing all other U.S. ports with 516,757 loaded TEUs handled that month. First-quarter 2025 performance shows sustained 10% growth momentum.

Port of Savannah - Fastest Growing Major Port

The Port of Savannah emerged as the fastest-growing major port with 5.6 million TEUs in 2024, representing approximately 618,000 TEU increase from 2023. The port achieved 4th place nationally and 3rd on the East Coast, with April 2025 setting a new record at 515,500 TEUs. Georgia Ports Authority projects reaching 12 million TEU capacity by 2030 through a planned $4.2 billion investment program.

Port of Montreal - Operational Resilience

The Port of Montreal faced significant challenges but demonstrated operational resilience with 35.26 million metric tonnes of total cargo in 2024. Container throughput reached 1.46 million TEUs despite labor disruptions causing a 4.8% decline. The port's ambitious Contrecœur terminal expansion project will add 1.15 million TEU capacity, increasing total port capacity to 3.25 million TEUs by the mid-2030s.

Infrastructure Investments Reach Unprecedented Scale

Los Angeles Infrastructure

- $73 million Pier 400 rail expansion completed

- Three new super-cranes deployed

- $230 million in 2025-26 capital projects

Vancouver Expansion

- $350 million Centerm project completed

- Roberts Bank Terminal 2: $3.5 billion investment

- 2.4 million TEU capacity addition

New York/New Jersey Harbor Deepening

New York/New Jersey launched a landmark $19.2 million harbor deepening study in December 2024 to expand channels from 50 to 55 feet depth, accommodating 18,000 TEU vessels. The port secured over $200 million in private terminal investments, including major expansions at Howland Hook Marine Terminal and APM Terminals Elizabeth.

Savannah's Mega Rail Facility

Savannah's $220 million Mason Mega Rail facility achieved full operational status, doubling rail capacity to 2 million TEUs annually. This 85-acre facility, the nation's largest on-dock intermodal rail operation, eliminates 200,000+ truck trips annually while enabling 24-hour vessel-to-rail container movement.

Montreal's Contrecœur Terminal

Montreal's Contrecœur terminal project secured critical funding milestones with Quebec adding $130 million in February 2025, bringing total provincial commitment to $260 million alongside $450 million in federal support. Construction is expected to commence in 2025 with completion targeted for the early 2030s.

Labor Challenges Create Operational Uncertainty

East Coast Strike Impact

The 2024-2025 period witnessed unprecedented labor disruptions affecting major North American ports. The October 2024 East Coast strike involving 45,000 dockworkers at 36 ports from Maine to Texas resulted in estimated $4.5 billion daily economic losses before resolution after three days. The International Longshoremen's Association secured a 62% wage increase over six years, but automation disputes remain unresolved with a critical January 15, 2025 deadline.

Canadian Port Disruptions

Canadian ports experienced severe disruptions with Vancouver and Prince Rupert facing lockouts beginning November 4, 2024, affecting over 700 foremen and causing $800 million CAD in daily trade impacts. Montreal endured strikes starting October 31, 2024, involving 1,200 dockworkers and affecting 40% of container traffic. The Canadian government imposed binding arbitration to resolve both conflicts.

Automation: The Central Labor Issue

Automation technology emerged as the central labor relations issue, with East Coast unions demanding complete bans on automated equipment while port operators seek competitive modernization. This fundamental disagreement threatens continued operational stability and affects long-term infrastructure investment strategies across the continent.

Environmental Initiatives Drive Sustainable Port Development

Clean Ports Programs

North American ports are advancing aggressive environmental initiatives supported by substantial federal investments. The Biden administration's $3 billion EPA Clean Ports Program provides unprecedented funding for zero-emission port equipment and infrastructure upgrades.

Los Angeles

$370 million grant secured for reducing port-related emissions through electric equipment deployment

New York/New Jersey

$344 million allocated for zero-emission cargo handling equipment

Savannah

Comprehensive wetlands protection and restoration programs

Vancouver's Green Shipping Corridor

Vancouver launched the Prince Rupert-Vancouver green shipping corridor, pioneering sustainable maritime transport through alternative fuel infrastructure, shore power expansion, and cargo optimization technologies.

Montreal's Sustainable Development

Montreal's Contrecœur terminal incorporates cutting-edge environmental design, featuring electric rail connections, automated gate systems, and habitat preservation measures to minimize ecological impact.

Technological Innovation Transforms Port Operations

Digital Infrastructure Advances

North American ports are implementing advanced technologies to enhance operational efficiency:

- Los Angeles: Port Optimizer™ digital platform provides real-time cargo visibility

- New York/New Jersey: Automated gate systems reduce truck processing times by 50%

- Vancouver: PortConnect system integrates supply chain stakeholders

- Savannah: Network Operations Command Center monitors 24/7 operations

Automation Implementation Status

Despite labor resistance, selective automation continues advancing at major ports. West Coast ports operate with 30-40% automation levels, while East Coast facilities maintain largely manual operations pending labor negotiations. The technology divide creates competitive disparities affecting cargo routing decisions and long-term port viability.

Trade Dynamics Reshape Continental Logistics

Nearshoring Impact

North American ports benefit significantly from nearshoring trends driving 17% growth in Mexican port volumes. Companies relocating Asian manufacturing to Mexico increase demand for continental transportation networks, positioning ports as critical supply chain nodes.

Import Surge Patterns

Container freight imports demonstrate strategic frontloading behaviors, with importers accelerating shipments 12% above normal levels during November-February periods. This pattern reflects proactive inventory management responding to potential trade policy changes and seasonal demand cycles.

East-West Competition

The San Pedro Bay complex maintains dominance with 31% of U.S. containerized trade, leveraging superior Asian connectivity and rail networks. However, East Coast ports captured market share gains through infrastructure investments and proximity to population centers, intensifying continental competition.

Industry Statistics Reveal Continued Expansion

North American port infrastructure encompasses approximately 360 commercial ports in the United States and over 550 port facilities in Canada, confirming the continent's extensive maritime network capacity.

The industry demonstrated remarkable resilience with container import volumes reaching 2.52 million TEUs in September 2024, a 14.4% year-over-year increase.

Significant Ranking Shifts

The Port of Baltimore dropped from top-10 status following the Francis Scott Key Bridge collapse in March 2024, handling only 348,869 TEUs through October. Meanwhile, West Coast ports benefited from East Coast labor uncertainty, with all major Pacific gateways recording double-digit growth rates.

Future Infrastructure Requirements

Capacity Expansion Needs

North American ports face critical capacity constraints requiring massive infrastructure investments. Current projections indicate need for $163 billion in capital improvements through 2025 to accommodate projected trade growth and vessel size increases.

Channel Deepening Projects

- NY/NJ: 50 to 55 feet depth expansion

- Savannah: Completed 47-foot channel depth

- Montreal: St. Lawrence Seaway modernization

Terminal Expansions

- Vancouver: 2.4M TEU capacity addition

- Montreal: 1.15M TEU Contrecœur terminal

- Savannah: 12M TEU target by 2030

Rail Infrastructure Critical

Intermodal rail connectivity emerges as the critical infrastructure bottleneck. Ports invest heavily in on-dock rail facilities to reduce truck congestion and improve inland distribution efficiency. Savannah's Mason Mega Rail facility exemplifies this trend, eliminating 200,000 annual truck trips through direct vessel-to-rail transfers.

Industry Outlook Shows Sustained Growth Momentum

The North American port sector demonstrates exceptional resilience and growth trajectory despite operational challenges. The combination of record volumes, infrastructure investments, and technological advances positions the industry for continued expansion.

Federal Commitments

$163 billion in planned capital investments through 2025 and $3 billion in EPA Clean Ports Program funding for zero-emission equipment.

Capacity Expansion

Los Angeles targeting continued volume growth, Vancouver planning 30% west coast capacity increases, and Savannah projecting 12 million TEU capacity by 2030.

Trade Evolution

Trade pattern evolution continues favoring North American gateways through nearshoring trends and supply chain diversification strategies.

Critical Success Factors

Port competitiveness increasingly depends on three critical factors:

- Labor Relations Stability: Resolution of automation disputes and contract negotiations determines operational reliability

- Infrastructure Investment: Sustained capital deployment for capacity expansion and modernization

- Environmental Compliance: Meeting stringent emissions targets while maintaining operational efficiency

Long-Term Growth Outlook

North American ports project sustained growth through 2030, with container volumes expected to increase 40-50% from current levels. The combination of nearshoring benefits, infrastructure investments, and strategic geographic positioning ensures continental ports remain critical nodes in global supply chains. Success requires balancing technological advancement with labor relations while meeting environmental mandates and capacity demands.

The unprecedented 2024 performance across major North American ports—from Los Angeles's 10.3 million TEUs to Vancouver's historic cargo volumes—demonstrates the industry's fundamental strength. As global trade patterns evolve and supply chains reconfigure, North American ports stand uniquely positioned to capture growth opportunities while serving as essential economic engines for continental prosperity.

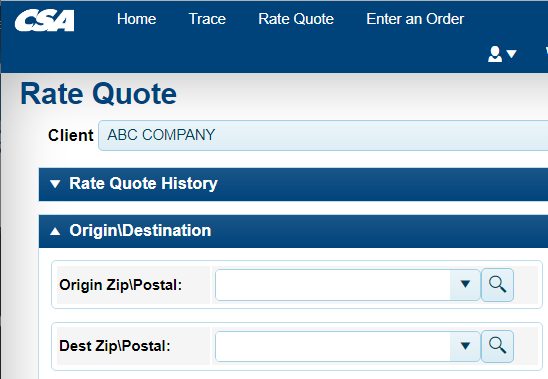

Why Choose CSA Transportation

At CSA, we understand the importance of finding the fastest most cost effective transit for your shipments. Over the last 34 years, we developed a proven system for ensuring that the supply chains keep moving without a hitch, no matter where you need your shipment to go.

CSA has shipping centers at major North American ports, including hubs in Los Angeles, New York / New Jersey, Vancouver, Montreal, and an Atlanta trucking terminal that correspond to the locations mentioned above. Because of our vast network of strategically location distribution centers we can provide you with reliable transportation throughout Canada and the USA no matter what happens.

If there’s a shipping strike or another issue at one of the largest shipping ports in the US, you can redirect to a different port on the West Coast and use CSA's distribution network to bring your freight back into it's original destination. For instance, if a strike happens in Los Angeles, you can reroute your cargo to Seattle, San Francisco, or other alternatives and CSA's trucking network can take it from there.

In many cases the fastest way to transport your goods from China is to ship it to the most northern pacific port. For instance, shipping to Vancouver from China makes more sense if you need to deliver to Canada, as the shipping transit days is shorter. Once your freight arrives in Vancouver CSA can help you with pallet delivery to your customers.

To learn more about our services, request a quote today. We’ll be able to answer any questions you might have regarding the particular details of your shipment.