What is Freight Insurance Coverage? Everything You Need to Know

The financial impact of a lost or damaged freight shipment can cripple your business operations. In a market where customers expect prompt and safe delivery, ensuring your shipments are safeguarded is crucial. A freight insurance policy acts as a critical safety net, offering comprehensive protection for your cargo that goes beyond the scope of carrier liability. Let’s take a closer look at how freight insurance works and how it can help your shipping operations.

What is Freight Insurance?

Freight shipping insurance financially protects your shipments while they are in transit. It is also sometimes referred to as cargo insurance coverage. If your shipments are lost, stolen, or damaged, you’ll receive compensation. This can help you eliminate some of the frustrating expenses that come with replacing a lost or damaged shipment. In order to qualify for reimbursement, the incident must align with the terms laid out in your policy.

There are different types of cargo freight insurance policies on the market. You can opt to purchase individual policies for each shipment, which gives you the option to adjust coverage on a case-by-case basis. However, if you make shipments frequently, you can also opt for a comprehensive yearly policy that covers all your shipments.

Freight insurance is a must for any business with regular shipping operations. Without it, you could end up spending a significant amount of money to recover items that have been lost or damaged in transit — even if the incident isn’t your fault.

Carrier Liability vs Freight Insurance

While often used interchangeably, 'carrier liability' and 'freight insurance' refer to distinctly different types of insurance for freight shipping. All shipping carriers offer some form of cargo liability insurance coverage as part of their services.

This liability insurance is limited and may not cover the full value of your shipment. Carrier liability insurance is also fixed, which means you can’t adjust the coverage for higher-value shipments. On top of that, the claims process for liability insurance is lengthy and complex. To file a claim, you must prove that the carrier was at fault for the loss or damage of your shipment. This may not always be possible, particularly if there are third parties involved in the incident.

Alternatively, freight insurance is a form of additional coverage that covers the entire value of your shipment. This policy also provides coverage for shipping damage or losses, regardless of who is at fault. While purchasing freight insurance is optional, it provides extra coverage and peace of mind that standard carrier liability insurance does not.

What Does Freight Insurance Cover?

Freight insurance covers the full value of your shipment. This type of insurance provides coverage for a variety of different scenarios, including:

- Shipment theft

- Damage or loss due to weather-related incidents

- Damage or loss due to vehicle accidents

- Other scenarios that damage the shipment

Benefits of Freight Insurance Coverage

Investing in freight insurance offers several key benefits that protect both your financial interests and your business reputation.

Financial Protection

Replacing a lost or damaged shipment can be very expensive. Not only will you lose out on the cost of the item itself, but you could also end up spending more money in customer reimbursements and express shipping for replacement items. If a particularly large shipment is damaged, it could cause significant disruption to your business’s finances.

With freight insurance, you’ll be reimbursed quickly if something happens to your shipments. This way, unforeseen shipping issues won’t prohibit you from reaching your financial goals. You’ll also be able to resolve problems much more quickly, knowing that you will be reimbursed within a reasonable amount of time.

Taking out a freight insurance policy requires you to invest some money upfront. However, the financial protection you’ll get is significantly more valuable than the amount you’re initially spending.

Peace of Mind

Another huge benefit of transportation insurance coverage is the sheer peace of mind you’ll get. When you’re relying heavily on shipments to keep your customers happy, it’s natural to worry about whether they’ll get to their destination safely.

Freight insurance gives you extra peace of mind, knowing that your shipments are fully protected in the event of an emergency. The no-fault aspect of freight insurance is particularly comforting for many shippers. There’s no need to prove that the carrier or another third party is responsible for the damage — you’ll be reimbursed regardless of who was at fault as long as it meets the terms and conditions of your policy.

Customer Satisfaction

Freight insurance isn’t just beneficial for your bottom line — it’s beneficial for your customers, too. Your customers rely on you to get their shipments, and they’ll want to know that you’re doing everything you can to protect their order. Freight insurance shows your customers that you are a trustworthy shipping provider and can help them feel more comfortable ordering from you.

What to Look for in Freight Insurance Coverage

When purchasing transport insurance coverage, there are many different providers to choose from. The quality of freight insurance coverage can vary significantly between policies. It’s essential to be discerning when selecting your policy to ensure your shipments are properly protected. Here’s what to look for in a freight insurance provider.

Comprehensive Coverage Options

Not all shipments will require the same level of coverage. It’s important that your provider offers a wide range of coverage options. This way, you can choose the coverage that is truly the best fit for your shipments rather than settling for a one-size-fits-all policy.

Ideally, your insurance provider should have policies for different shipping modalities, including ground, air, and maritime shipping. This is particularly important if you use a multi-modal shipping strategy. International shipments may also need coverage that is different from domestic shipments.

Your provider also should have options available for different types of freight. For fragile or high-value items, consider policies that provide specific extra coverage, ensuring complete financial protection against potential damages or losses. A good insurance provider will work with you to find the best option for your company’s needs.

Transparent Claims Process

If you need to file a claim for your shipment, you’ll want to make sure that your insurance provider will respond quickly. Choosing an insurance provider with a transparent, straightforward claims process is essential so you’ll know exactly what to expect.

If the process is too complex, you might be less inclined to file a claim, which can negatively interfere with your operations. It could even dissuade you from filing a claim when you need to, resulting in the complete loss of your shipment.

Ideally, you should be able to file a claim online and receive reimbursement quickly. Your provider should also offer clear instructions about the documents you must provide and how to successfully submit a claim. You may need to provide photos and other evidence to qualify for reimbursement. Customer service should also be readily available in case you need additional support.

Flexibility and Customization

Every shipping company has different insurance needs, and it's normal for these needs to change as your business grows. Your insurance provider should offer customization options to accommodate these changes. This way, you can build an insurance policy that addresses your specific shipping concerns. For example, if your shipping routes are frequently affected by bad weather, you’ll want an insurance provider that can offer coverage specifically for weather damage.

A responsive and flexible customer service team is also crucial. If you encounter an issue with your policy, your provider should be able to address it right away and work with you to find the best possible solution. The best insurance providers can even help you build a custom policy if none of their standard options fit your needs.

Business Reputation

Finally, it’s essential to consider the insurer’s reputation when selecting a policy. You’re relying on your insurance provider to reimburse you and support you in the event of a shipping emergency, so you need to ensure they are trustworthy.

In particular, it’s critical to ensure your provider is financially stable. This may require researching the company’s history and credit ratings. Your provider should be financially stable enough to pay claims quickly and consistently, regardless of the current state of the economy.

It can also be helpful to read reviews and testimonials from past customers when choosing an insurance provider. Ideally, your provider should have a long history of insuring shipments similar to yours. Look for an insurer with a reputation for on-time payouts and caring customer service.

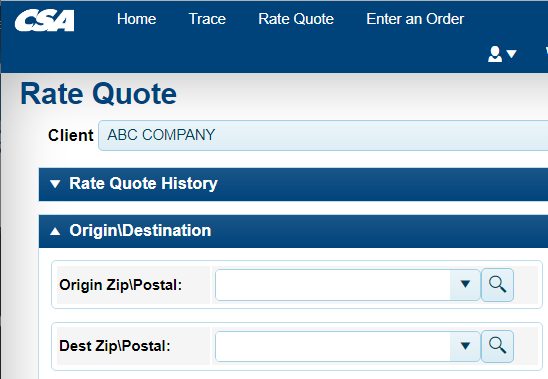

Freight Shipping Solutions from CSA Transportation

While freight insurance safeguards against financial losses, partnering with a reliable and efficient shipping provider like CSA Transportation is essential for surpassing delivery expectations and ensuring total customer satisfaction. Our expansive freight network across the USA and Canada, coupled with strategic regional distribution centers, provides unparalleled flexibility and coverage. With scheduled daily departures and options for same-day pickups, we customize services to meet your unique business needs. Ready to elevate your logistics operations? Contact CSA Transportation today to discover how our tailored shipping solutions can boost your efficiency and operational success.